LatAm Investor

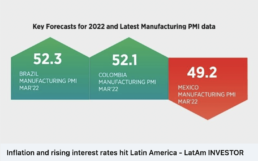

Inflation and rising interest rates are set to dampen the region’s economic recovery, writes Pollyanna De Lima, Economics Associate Director Economic Indices, S&P Global…

In line with the global picture, the economic outlook for Latin America has weakened since the last issue as prevailing headwinds were exacerbated by the Russia-Ukraine war. Rising interest rates, acute price pressures, income squeezes, turbulence in capital flows and COVID-19 loom large as key risks to growth.

Official statistics data showed that output returned to pre-pandemic levels in Brazil and Colombia, but Mexico is yet to post a full recovery. Timely PMI (Purchasing Managers’ Index) data indicated that Brazil’s manufacturing sector recovered in March from the pandemic- related downturns seen around the turn of the year, with growth gathering pace in Colombia. Economic conditions remained challenging in Mexico, however, as goods production fell at a faster pace at the end of the first quarter.

In January’s update of the World Economic Outlook, the IMF downgraded the 2022 GDP forecasts for Brazil (from +1.5% to +0.3%) and Mexico (from +4.0% to +2.8%), owing to the new wave of COVID-19, the reintroduction of restrictions, energy price volatility and lingering problems in supply chains. Further downward revisions are expected in the April update as the impacts of Russia’s invasion of Ukraine are accounted for alongside strong monetary policy tightening in response to mounting inflationary pressures and their bearing on consumption and investment.

Americas Quarterly

Financing Climate Change Adaptation in Latin America

Climate change poses an urgent threat to the Western Hemisphere and will be a top agenda item at the Summit of the Americas in June. How can tools like green bonds and ESG requirements assist in the transition to a low-carbon economy? On May 26, Americas Quarterly convened a group of experts to discuss green finance and climate change adaptation strategies for Latin America. This event launched AQ’s special report on the Summit of the Americas.

This event was hosted by:

The event was livestreamed on this page on May 26, 2022 at 10 a.m. ET.

You can also watch this event on Twitter and YouTube.

Speakers:

- Reina Irene Mejía Chacón, Executive Vice President at the Inter-American Development Bank

- Laura Segafredo, Global Head of Sustainable Research, ETF and Index investments at BlackRock @LauraSegafredo

- José Daniel Madrigal, Economics Specialist at the Honduras Resident Coordinator’s Office of the United Nations @JoseMadrigal92

- Brian Winter, Vice President for Policy, AS/COA and Editor-in-Chief, Americas Quarterly @BrazilBrian (moderator)

SASB Standards

SASB Standards connect business and investors on the financial impacts of sustainability.

Integrating SASB Standards Into a Dynamic ESG Composite Score

Environmental, social, and governance (ESG) factors are among the most significant drivers of change in the world today with major implications for businesses and long-term investors. Global markets are increasingly focusing on factors that drive long-term enterprise value, and intangibles now represent the lion’s share of this value. Investors regard many ESG matters as critical elements of corporate resilience with a growing focus on corporate behavior, climate change, technological evolution, social equity, and human capital management.

Coronation

We are the leading financial service partner that helps build enduring legacies for sustainable wealth creation in Africa.

The theme for 2022 is centered on nutrition. Let us help grow nutrition resilience and protect our continent's food security. What will you do towards this today? #AfricaDay #NutritionAndFoodSecurity #Together

Coronation is a leading African financial services provider. We know you want solutions tailored to your unique challenges, so we go beyond the ordinary to deliver the best products and services to our clients and markets.

CrossBoundary

Helping CrossBoundary in its mission to unlock the power of capital for sustainable growth and strong returns in underserved markets.

Sustainable Energy For All Forum

MTS expands access to Latin American bond markets through BondsPro

MTS Markets International (MMI) is excited to announce that it has expanded its client reach in Latin America through its marketing agreement with Marco Polo Securities (MPS). Building on its Mexico announcement earlier this year, MPS will introduce the MTS BondsPro electronic trading platform to new and existing institutional clients in Argentina and Uruguay.

As part of this expansion, fixed income traders will have electronic order book access to Argentine- and Uruguayan peso-denominated corporate and treasury bonds, and will become part of the international BondsPro trading community of more than 600 broker-dealers and buy-side clients participating in the BondsPro all-to-all order book. Growing benefits of MTS BondsPro participation include liquidity from over 100 dedicated providers, access to over 20,000 corporate bonds with live prices daily, and a robust pre-trade data offering.

This move is part of a growing focus by MMI on the emerging markets trading community. In fact, MTS BondsPro volume from emerging markets more than doubled from 2018 to 2019, consistent with a growing interest in electronic trading of emerging market fixed income securities by global investors. And this volume has nearly doubled again in 2020, up approximately 95% year-to-date.*

David Parker, Head of MTS Markets International:

“Given the heightened market volatility in 2020 driven by the global pandemic and other factors, we’ve seen a growing interest in emerging markets fixed income. The buy-side community is helping to drive regional demand and are asking for the higher liquidity, transparency and more robust compliance platforms that can be found in the all-to-all electronic trading model. We are delighted to extend access to our rapidly growing MTS BondsPro global fixed income community to a wider set of Latin American market participants and look forward to welcoming new joiners to the global BondsPro community.”

Chava Salvador Palma, Head of Sales Latin America, Marco Polo Securities:

“With the rapid shift from the sell-side to the buy-side in Latin America, electronic trading volume has grown along with increasing demand for liquidity and growing compliance needs. In emerging markets like Mexico, Argentina and Uruguay, clients can benefit from the powerful combination of Marco Polo’s local insight and relationships with MTS’ global scale and technology. MTS BondsPro is an expanding liquidity venue for Latin American fixed income institutional investors and we are excited to partner with a global brand and proven technology leader as we return to our mission of bringing efficiencies to Latin America’s capital markets.”

For more information, contact your MTS or Marco Polo representative or visit us at:

https://protect-eu.mimecast.com/s/rSJSCkrjKTooNyGuVqxDa?domain=mtsmarkets.com

Mathew McConnell +1 914-960-9711

CEO mmcconnell@mpsecurities.com

Marco Polo Securities

*Source: MTS.

BondsPro is a US-registered ATS available to clients with trading authorization in the US, UK, Switzerland, Bulgaria, Mexico and Malta. This is not an offer to sell or a solicitation to buy where MTS Markets International, Inc. (MMI) is not registered, authorized or qualified by an exemption.

Join AQ Editor-in-Chief Brian Winter and panel guests Reina Irene Mejía Chacón, Laura Segafredo and José Daniel Madrigal at 10 am this Thursday, May 26 for a conversation about green finance and climate adaptation in Latin America.

Sign up here for this virtual event: https://lnkd.in/eezDhRMF